Central government spending limits

At the beginning of the parliamentary term, the Government decides on the parliamentary term spending limits, i.e. a ceiling for budget expenditure, as well as the rules governing the spending limits procedure for the entire four-year parliamentary term. The spending limits’ allocation for each administrative branch is reviewed within the parliamentary term spending limits in March-April as part of the General Government Fiscal Plan. Decisions are made on the basis of the spending proposals of the ministries’ administrative branches. For the administrative branches, the General Government Fiscal Plan serves as a guide to the preparation of the following year’s draft budget.

Spending limits procedure

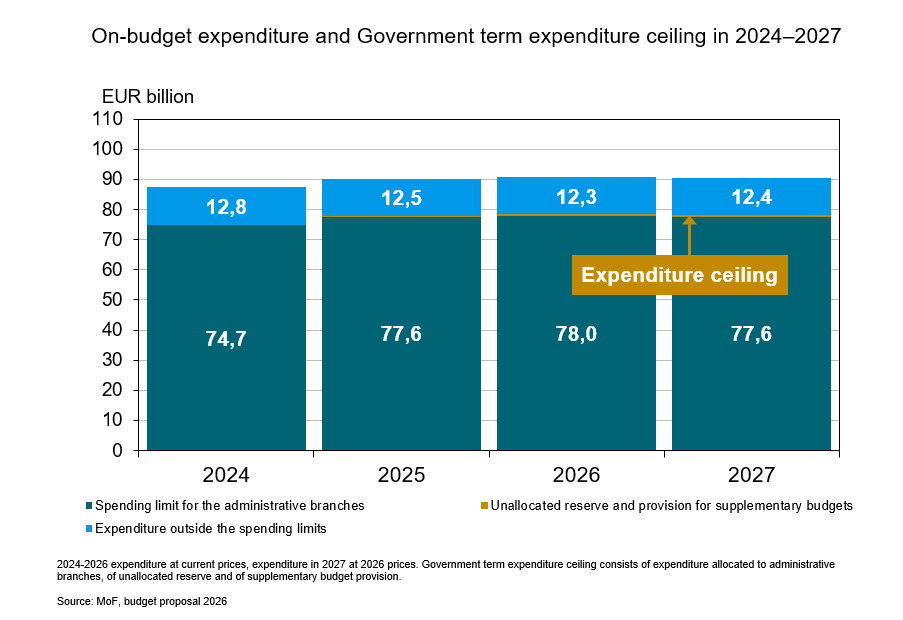

Around four-fifths of central government budget appropriations are allocated in accordance with the spending limits framework, which is binding for the whole parliamentary term.

The annual General Government Fiscal Plan reviews the spending limits allocations for each administrative branch and updates the spending limits to correspond with changes in price and cost level as well as changes in the structure of spending limits expenditure. In the annual decisions, the spending policy defined in the Government Programme and in the parliamentary term’s first General Government Fiscal Plan, which is the basis for the parliamentary term spending limits, is not changed.

The central government spending limits system is a key instrument of the Government’s fiscal policy steering and the foundation of a credible economic policy. In its programme, the Government of Prime Minister Petteri Orpo is committed to the spending limits procedure for central government expenditure and the permanent appropriation decisions outlined in the Government Programme that will lead to expenditure within the spending limits being EUR 1.5 billion smaller in 2027 than in the central government spending limits decided on 23 March 2023 (at 2024 prices). The entries and other measures of the Government Programme will be implemented within the restrictions of the parliamentary term spending limits.

An annual provision of EUR 400 million is made for supplementary budgets in the spending limits of the government term. The Government may spend no more than EUR 100 million of the supplementary budget provision in 2027. If the level of expenditure falls below that specified in the spending limits after supplementary budgets, the difference, to a maximum of EUR 200 million, may be used for one-off expenditure in the following year without reference to the spending limits.

The purpose of the spending rule is to limit the total amount of expenditure incurred by the taxpayer. When changes are made in the Budget that are neutral from this perspective, corresponding adjustments may be made in the spending limits of the parliamentary term. Spending limit adjustments will be applied as necessary to ensure that the spending limits do not constrain re-budgeting of expenditure and changes to the timing of expenditure items.

Fighter aircraft purchases have been included in the spending limits. The indexation and exchange rate expenditures under the procurement agreement will be taken into account as part of the spending limits price correction. Reallocations and changes of timing are possible within the package. Any difference arising if the costs incurred for fighter aircraft purchases during the spending limits period fall below the spending limits provision will not be used to increase other expenditure.

The finances of the National Housing Fund and the Development Fund of Agriculture and Forestry will also be brought within the spending limits insofar as the Budget justifications take a position on the levels of their expenditure. Transfers in this respect from the Budget to these funds will correspondingly remain outside the spending limits.

The Government will not use tax relief or tax subsidies to circumvent the spending limits. The Government will likewise not use any share transfers, assignment of debts, funds or other means to circumvent the spending limits in a manner that is contrary to their purpose. A systematic assessment of this will be incorporated in Government policymaking.

Expenditure outside the spending limits

Outside the scope of the spending limits are particularly expenditures affected by cyclical fluctuations and automatic stabilisers, i.e.

- Cyclical expenditure, i.e. unemployment security expenditure, social assistance expenditure, wage guarantee and housing allowance. These expenditures are, however, included in the spending limits if changes that have expenditure effects are made to their criteria

- Interest expenditure on central government debt

- Compensation to other tax recipients for changes in taxation (including social security contributions) decided by central government

- Expenditure corresponding to technically transmitted payments and external funding contributions (e.g. expenditure corresponding to funding from the EU’s Recovery and Resilience Facility (RRF))

- Financial investments (A financial investment is nevertheless counted as an expenditure included in the spending limits if it is deemed a final expenditure at the time of making the decision.)

- Value-added tax expenditure

- Funding for the Finnish Broadcasting Company (“transfer to the State Television and Radio Fund”).

New and temporary defence materiel, civilian material and humanitarian aid intended for supporting Ukraine due to the Russian invasion will also be covered outside the spending limits.

Dispensation mechanism

The spending limits include a dispensation mechanism with a view to ensuring the ability of economic policy to react to highly exceptional and significant external crisis situations that are beyond the Government’s control in the manner that the circumstances require, and to limit economic policy manoeuvrability solely to additional appropriations that are essential from the point of view of the crisis without compromising the credibility of economic policy. Use of the dispensation mechanism may only be triggered by the emergence of an unusual event that Finland is unable to prevent and that has a significant impact on the balance of public finances (such as a pandemic, a war, or circumstances of preparing for extensive terrorism).

The Ministerial Committee on Economic Policy will decide whether the criteria for deploying the dispensation mechanism have been met, on the content of the spending limits deviation to be deployed, and on a recommendation to the Government concerning deployment of the dispensation mechanism on the presentation of the Ministry of Finance. The preparations of the Ministry of Finance will include consulting the Bank of Finland, and other specialist parties that the Ministry deems essential, having regard to the nature of the crisis.

General Government Fiscal Plan 2022-2025

General Government Fiscal Plan 2021-2024

General Government Fiscal Plan 2020-2023, October 2019

General Government Fiscal Plan 2020-2023

General Government Fiscal Plan 2019-2022

General Government Fiscal Plan 2018-2021

General Government Fiscal Plan 2017-2020

General Government Fiscal Plan 2016-2019 (28 September 2015)

General Government Fiscal Plan 2016-2019

Finland's Stability Programme 2014

Government Decision on General Government Spending Limits for 2014-2017

Government Decision on General Government Spending Limits for 2013-2016

Revised Central Government Spending Limits for 2012-2015

Decision on Central Government Spending Limits for 2011-2014

Operational and financial planning

The Government’s operations and finances are planned for several years ahead. The goal is to ensure that the ministries take the Government’s financial and operating policy guidelines into account in their fields of activity. Planning covers the setting of objectives as well as analyses of actual costs and periodic evaluations of financial management.

Each ministry has operational effectiveness and performance plans for multi-year periods. As a rule, operations and finances are planned for a four-year period. Planning includes, among other things, general operating polices and priorities as well as the key social effectiveness and performance objectives.

Operational and financial planning is the basis for preparation of the central government spending limits and the annual Budget. Each ministry’s spending proposal includes a baseline scenario stating the level of appropriations already decided. In addition, each ministry may submit development proposals as well as an estimate of administrative branch appropriations that fall outside the scope of the spending limits and revenue estimates.

Contact information

Senior Ministerial Adviser

Annika Klimenko

02955 30180

annika.klimenko(at)gov.fi